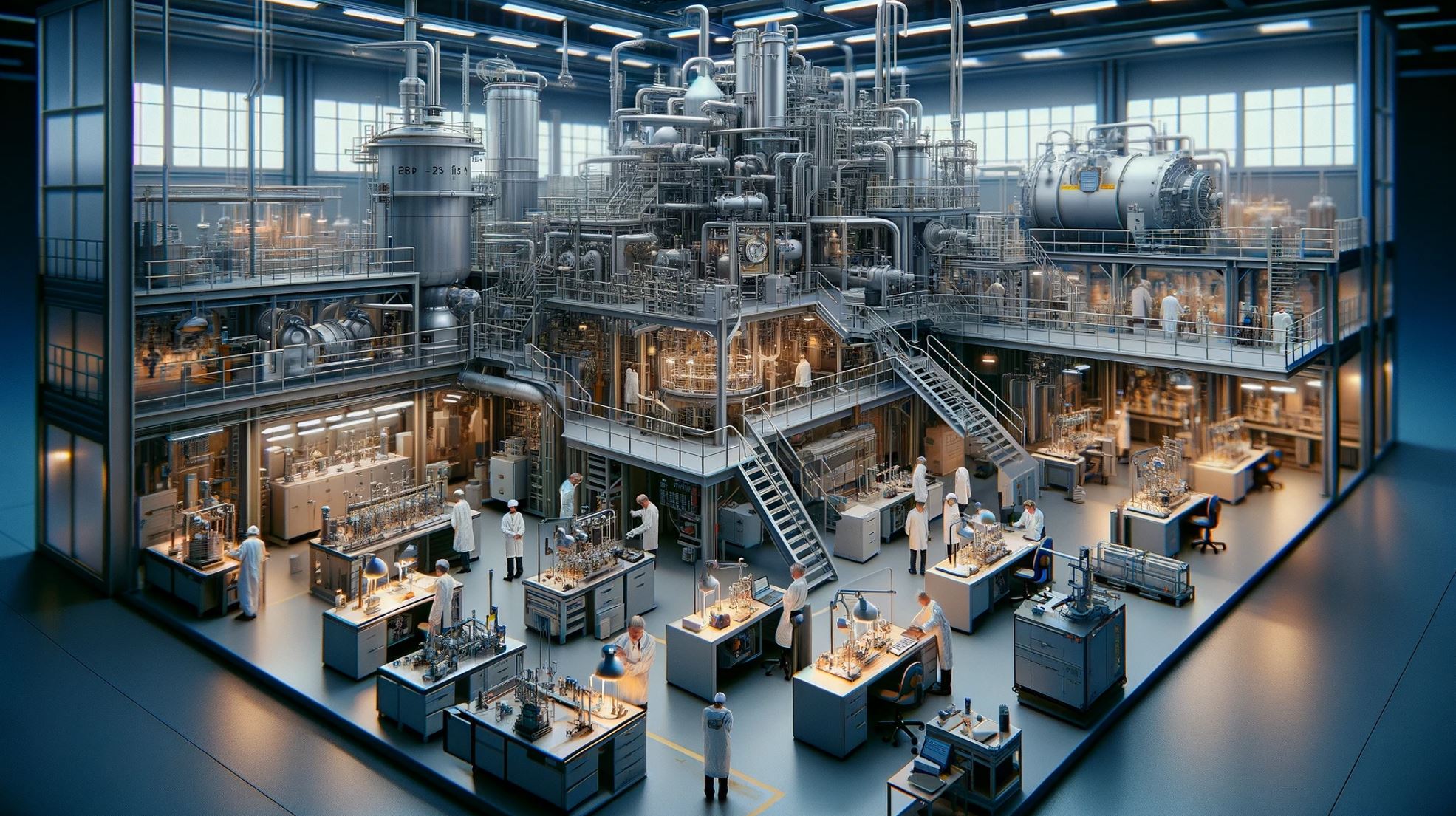

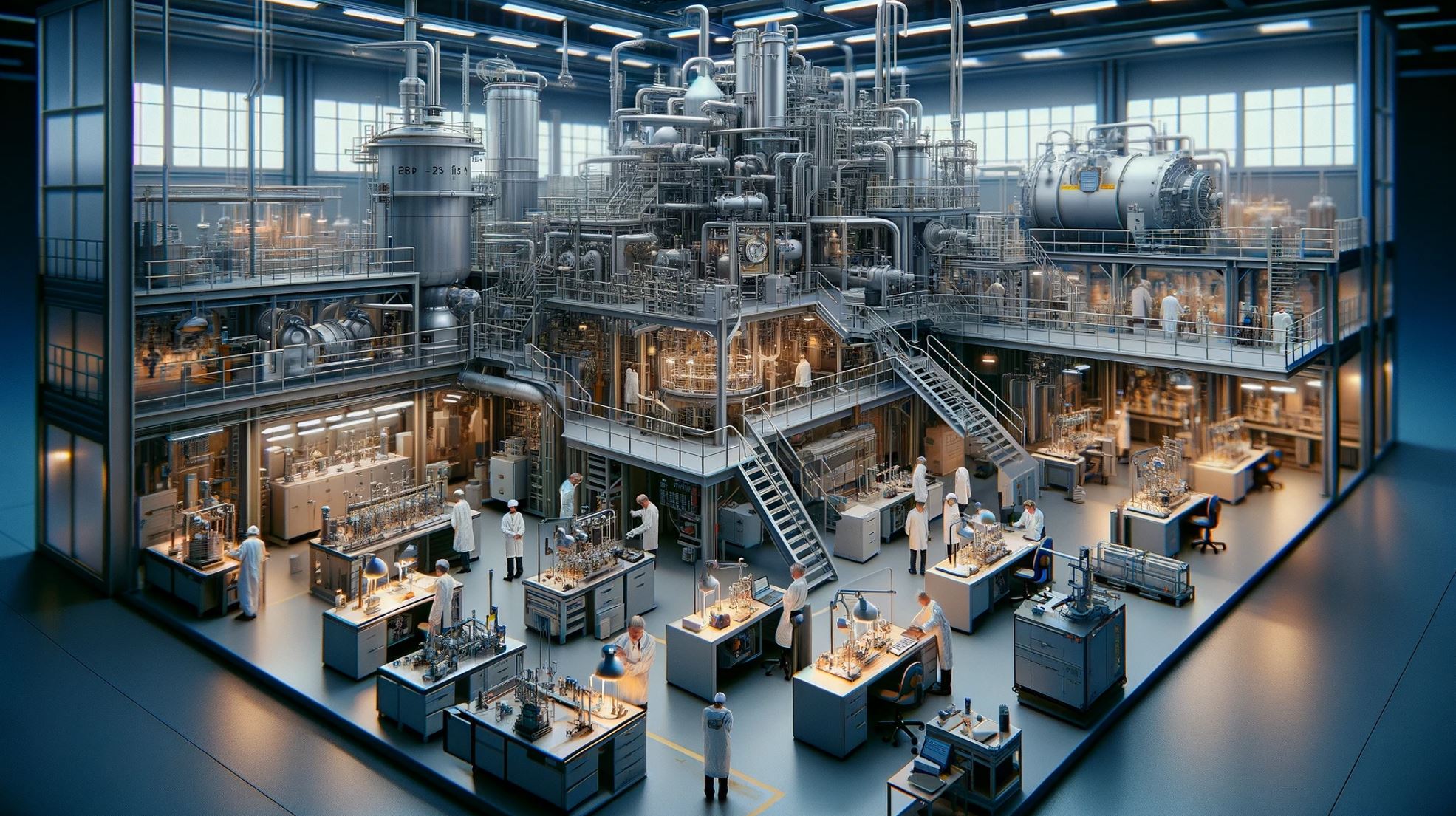

The critical first lens on every new project—and the ongoing health-check of every running plant

Big ideas and busy plants share one truth: assumptions, if left untested, become expensive surprises. OSVARD’s Feasibility Studies and Audits service gives small- and mid-sized producers the same rigorous gatekeeping practised by global majors—before steel is bought and while valves keep turning.

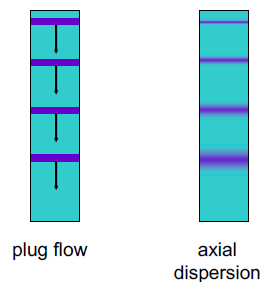

We map credible process routes, develop preliminary PFDs, and crunch mass-energy balances. Can raw materials be sourced locally? Does the chemistry scale without exotic metallurgy? Will utilities on site handle the peak load?

Our cost engineers layer CAPEX, OPEX, taxes, tariffs, and ramp-up curves into a cash-flow model that spits out NPV, ROI, and payback under multiple price scenarios. If the project can’t survive a 20 % feed hike or a 10 % market dip, you’ll know now—not after the ribbon-cutting.

Safety hazards, permitting timelines, waste-handling hurdles, feedstock volatility—all scored in a risk matrix with mitigation strategies and contingencies costed in.

Proceed, pivot, or park? Our independent report arms boards, banks, and partners with facts instead of wishful thinking—complete with sensitivity tornado charts and milestone roadmaps.

OSVARD engineers walk the lines, pull historian data, and benchmark yields, cycle times, and energy intensity against best-in-class metrics. Hidden bottlenecks and “it’s always been that way” work-arounds get surfaced and priced.

We dig into PHAs, MOC files, and maintenance logs, then tour the plant to see if paper matches reality. Gaps come with practical fixes—whether a missing block-and-bleed, a fatigued relief stack, or outdated operating procedures.

Flue-gas O₂ too high? Uninsulated 180 °C condensate return? We quantify the losses, suggest low-CAPEX fixes, and model the carbon—and utility-bill—payback.

Thickness checks, corrosion mapping, vibration snapshots, and weld record reviews rank equipment by risk so you spend maintenance dollars where failure really hurts.

Each audit closes with a prioritised action list tagged “quick win,” “budget item,” or “strategic upgrade,” complete with estimated cost, ROI, and recommended timeline.

Capital protected. A thorough feasibility study stops dead-end projects before they swallow funds better used elsewhere.

Margins widened. Process and energy audits typically uncover 5–15 % savings—achievable with tweaks rather than turbines.

Regulatory peace-of-mind. Pre-audit prep means fewer findings during official inspections and faster permitting for expansions.

Safer workplaces. Regular compliance audits catch lapses long before they become incidents.

A Thai specialty-resin start-up avoided a USD 4 M mis-step when OSVARD’s feasibility study showed the preferred solvent route would need a class-1 explosion-proof build, doubling capex. An alternate aqueous process met spec at half the cost.

Energy audit at a mid-sized agro-chem site cut steam use 11 % by fixing trap leaks, re-balancing condensate headers, and installing a small heat-recovery coil—payback under nine months.

Three-year OSHA PSM audit for a lubricant blender flagged missing MOC trails and overdue PHAs; OSVARD’s action plan cleared all findings ahead of the regulator’s return visit, avoiding fines and licence delays.

“Feasibility asks: ‘Should we?’ Audits ask: ‘Are we still?’ Together, they keep ambition honest and operations sharp.”

Whether you’re dreaming of a new product line or simply want proof your plant still performs like the day it started, OSVARD brings independent rigour, sector know-how, and clear, bank-ready reporting. Let’s turn risks into knowledge—and knowledge into confident decisions.