For natural scientists and engineers, it sometimes might be difficult to become with marketing, because it’s not as straightforward as their usual work. They love their creations so much that they might not get why others aren’t as excited. While customers may not always immediately see the value in these innovations. Sometimes the scientists may be even right.

For a company, developments and inventions are only to find a market and be soldto create a surplus of profits with which to finance and subsidize this research.

The ultimate aim of all efforts is to identify a market, which varies based on the product and diverse customer requirements. The demand for shelter is a fundamental need, presenting a potential global market opportunity.

1. Customer Needs – Product/Technology push Vs. Market pull

The “Product/Technology push” refers to a situation where an innovation or product is developed because of some technological advancement or because a company has identified something they believe is groundbreaking, rather than in response to an identified need in the market. some of believe of this thing are:

The “Market Pull“, the opposite of the above, occurs when a company develops a product or service in response to a direct need or demand in the market. some of believe of this thing are:

“Needs”, it may sound shitty, but it might be the most important thing to understand in developing a successful business. Even with advanced technology, robust intellectual property rights, and a skilled team, it’s essential to truly grasp the key concerns of your prospective customers (slow and often unsuccessful approach).

Identifying these needs can be complex. Numerous challenges arise when connecting with a potential client. Somethime, you might make any misunderstanding your customer as following example:

Customer needs are the internal factors that drive them to buy or use particular products and services.t’s essential to align what the customer needs with their reasons for needing it.

2. Key Customer Analysis

For designing, developing, and delivering a product that offers exceptional value to the customer, it is a conversational interview form that encompasses the diverse requirements of the customer. Given the time limitation of an interview, your inquiries should address the important question: “What is the customer looking for?”. If they don’t bring up an essential characteristic you’re aware of, it should be introduced as a topic of discussion.” There are several important considerations when conducting your interviews:

Finding the Appropriate Contacts

3. Market Segmentation & Evaluation

Market Segmentation refers to the process of dividing a broad target market into distinct subsets of consumers with similar needs, characteristics, or behaviors that might require separate marketing strategies or mixes. The main goal is to identify specific niches in the market to tailor marketing efforts effectively and efficiently.

Once market segments are identified, they need to be evaluated to determine their attractiveness and feasibility for targeting. Here are the criteria commonly used to evaluate market segments:

After evaluation, a company can decide which segments to target with specific marketing strategies. The process doesn’t end here, though. Regularly reviewing and updating segmentation as market conditions change is crucial to ensure that marketing efforts remain aligned with the evolving needs and behaviors of target customers.

4. Competitors & their product analysis

Competitor & its product analysis is the process of systematically gathering and analyzing information about a company’s competitors and their product in order to gain insights into their strengths, weaknesses, strategies, and performance. The primary goal of competitive analysis is to help a company make informed decisions and develop effective strategies to gain a competitive advantage in the marketplace. Here are some of the key components of competitive analysis

Competitive analysis is an ongoing process because the competitive landscape is dynamic, and competitors’ strategies can change over time. Regularly monitoring and updating your competitive analysis can help your company stay competitive in the marketplace and adapt to shifting industry trends and consumer preferences.

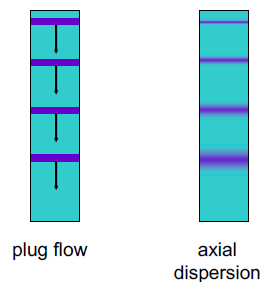

5. Driving Forces and Life Cycle Analysis

Driving forces refer to the factors or influences that create change, shape industry dynamics, and impact the competitive landscape of a particular market or industry. These forces are often external to individual companies but have a significant impact on their operations and strategies. Understanding these driving forces is crucial for businesses to adapt and thrive in a constantly evolving business environment. Here are some common examples of driving forces:

Life Cycle Analysis, also known as Life Cycle Assessment, is a systematic and comprehensive evaluation of the environmental impacts associated with a product, service, or process throughout its entire life cycle. This analysis takes into account all stages of a product’s life, from raw material extraction and manufacturing to transportation, use, and disposal or recycling. The main objectives of conducting a Life Cycle Analysis are:

Life Cycle Analysis and Driving Forces are valuable for businesses and organizations looking to minimize their environmental footprint, comply with regulations, meet sustainability goals, and make informed decisions about product design and resource use. Moreover, they allow businesses to anticipate changes, identify new opportunities, and adapt their strategies to remain competitive and responsive to market dynamics.

6. Industry analysis

it is the process of evaluating and understanding the dynamics, trends, opportunities, and challenges within a specific industry or market segment. It is a crucial step for businesses, investors, and policymakers to make informed decisions about entering, competing in, or investing in a particular industry. Industry analysis provides valuable insights into the competitive landscape, market potential, and factors that can impact the success of businesses within that industry. Industry analysis is typically performed through a combination of desk research, data collection, interviews, and market surveys.

7. Distinctive Competencies

Distinctive competencies, also known as “core competencies”, are unique and exceptional capabilities, resources, or skills that set a company apart from its competitors and enable it to create a sustainable competitive advantage in the marketplace. These competencies are specific to a particular organization and are “not easily replicated by others”. They form the foundation of a company’s strategic strengths and are a key driver of its success.

Examples of distinctive competencies can vary widely depending on the industry and company. Some examples might include:

For the ethylene production in the petrochemical industry, such competencies can be rooted in various facets of the business as example.

8. Supply industry

The term “supply industry” typically refers to industries that provide products, services, raw materials, or components that are essential inputs for another industry. The petrochemical industry, especially in the production of ethylene, relies on various suppliers to provide raw materials, equipment, and services essential for its operations. there are some key aspects of the supply industry within the chemical industry

The supply industry for the chemical sector is diverse and complex, encompassing a wide range of products and services tailored to the specific needs of chemical manufacturers. Establishing strong relationships with reliable suppliers and managing the supply chain effectively is crucial for chemical companies to ensure a steady flow of raw materials, maintain product quality, and remain competitive in the industry. Additionally, safety and environmental considerations are of paramount importance in the chemical supply industry to prevent accidents and protect the environment.

Key takeaways

In conclusion, successful businesses must continually assess and adapt to their operating environment and customer demands. Understanding customer needs, market pull approaches, is foundational. Key customer analysis, market segmentation, and evaluation help tailor strategies to meet specific customer requirements.

Competitive analysis, driven by industry forces and life cycle considerations, informs businesses about their competitive position and potential opportunities. Industry analysis provides insights into market dynamics and trends. Distinctive competencies and effective supply chain management are essential for achieving and maintaining a competitive edge.

By integrating these concepts and insights, businesses can make informed decisions, optimize their strategies, and position themselves effectively within their industry, ultimately leading to sustainable success.

Disclaimer:

The views and opinions expressed in this Linkedin article are solely my own and do not represent the views or opinions of my current employer. This article is a personal reflection and does not involve any proprietary or confidential information from my current company. Any similarities in ideas or concepts presented in this article to my current company’s work are purely coincidental.